Technology has been changing finance. Cloud, robotics process automation, and analytics are all now widely used as part of a company’s digital transformation.

But technology alone won’t get you the transformation you need. Not without a plan for how it should also change your organization and the demands on your people. Finance leaders are facing this challenge now as they shift their organizations from transactional processing and toward business partnering.

In our seventh finance benchmarking report, we mine the practices of the world's finance functions and draw on in-depth benchmarking studies we have performed for nearly 600 finance organizations around the globe so you can learn from the best of them.

This year, we explore how leaders are improving business results by investing in commercial insight, spending less time on transactional work and running at lower costs.

Stepping up: How finance functions are transforming to drive business results

Download the full report

Top performers keep costs down, while pursuing ambitious models for business partnering

In our analysis of finance cost as a percentage of revenue, top performers outperform the median company by 36 percent.

To do this they’re relentless about efficiency. And they’re laying out ambitious models for business partnering so they’re clear on where they are now and where they want the function to be in the future. When they do this, they build roles for people with the right skills and create conditions where finance can challenge the thinking of others, drive commercial insights, and focus on business results.

It all begins with simple questions: What services should finance provide the business? What data and technology need to be in place? What roles and skills enable the change we need?

Wherever possible it’s not about automating manual processes, it’s about using technology to eliminate the need for processes like bank reconciliation altogether. It makes you wonder. How much time is spent in the finance function doing what no longer needs to be done?

They’re funding insight work through new operating models and automation of finance tasks

Most finance leaders have already drawn upon traditional ways to increase efficiencies such as process standardization and shared services.

40% of finance effort could be aligned to more value driven activities through automation

Where there’s opportunity for efficiency, the question is less about which manual processes should be automated, and more about how technology could be used to eliminate some processes altogether.

Top-performing companies are busy investing time and money in harmonizing ERP systems, standardizing data definitions, and creating data strategies that will enable them to ask these bigger questions and act on them.

...and changing the skill profile in finance to be more insight driven

To be a true business partner, finance teams need highly skilled individuals with competencies and skills for problem-solving in the workplace, including soft skills such as communication, creativity, and teamwork.

In our benchmark group, four out of the five top priorities for to improve the finance function are related to improving team communication, collaboration, quality of relationships, and individual competencies and skills.

Not only do top-finance functions spend 20 percent more time on work that adds value, they also pay their ‘insight’ professionals more.

When you have this kind of automation activity, the skill set that you want to hire to is very, very different than what you hired to in the past. In addition to subject matter expertise, you need to have process capability.

Priorities for all finance functions

Adding value

Less than a quarter of finance time is spent delivering business insight

Focusing effort

Even in top quartile companies, analysts spend 40% of their time gathering data, not analyzing

Eliminating inefficiency

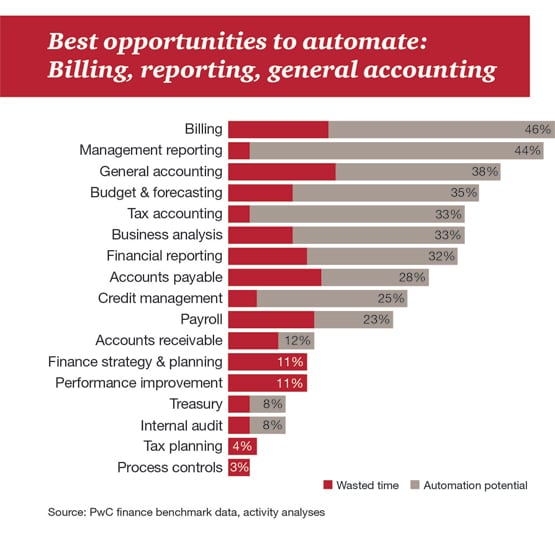

Across many key finance processes, automation and process improvement can reduce costs 35%—46%

Investing in skills

Top quartile companies pay their “insight” finance professionals 25% more

Making savings

Leading finance functions cost 36% less than the median finance functions

How we help

PwC provides deep, real-world industry and functional experience as well as peer group benchmarking of financial metrics. We help you simplify the identification of performance gaps, capitalize on the power of data-driven decision making and move quickly towards a more efficient, cost-effective way to do business. Our solutions and tools are designed to help CFOs succeed in an evolving role.

Contact us to learn more or read more about the service offering and solutions we provide.