About Us

The PwC Operational Improvement team works with organisations to rapidly improve their financial performance and increase enterprise value.

Our team of professionals are industry leading and highly skilled at where to find the optimal opportunities. They are supported by a rigorous and proven methodology, specialised processes, enhanced digital capability and extensive industry relationships.

At every step, our mission is to increase the value of our clients business. We do this by working with management to improve their teams capability, optimise growth opportunities, cut the waste and embed results based accountability.

All this adds up to a team that can support management through their businesses journey and implement the change required for profitable grow.

I want to

- Increase enterprise value

- Improve profitability

- Generate cash rapidly

- Destress the balance sheet

- Raise capital

- Help leading the restructuring

- Improve Management Capability

- Secure support of key stakeholders

- Improve the quality of management information

- Align organizational and operational strategies

- Optimise business processes

- Implement effective business controls

Increase enterprise value

We work alongside management to drive operational change and increase enterprise value. Combining our pragmatic restructuring skills and industry knowledge we support organisations with business planning, rapid cost reduction, cash generation and operational redesign.

Where management is under pressure to change the direction of the business we provide the support that gives them the confidence to make tough decisions and drive through change in a short timeframe.

Improve profitability

Often organisational focus on growth means neglecting profitability, we can help you to drive profitable revenue growth in markets where your business can optimise its differentiating capabilities.

Generate cash rapidly

We work with you to rapidly identify, prioritise and implement initiatives to 'stop the leaking taps' and increase cash, quickly.

Ensuring liquidity is managed efficiently, and that existing assets are used appropriately, is essential for all business and even more so in times of stress. We help businesses conserve and control cash, reducing outflows quickly, allowing management the time to plan.

This is, however, not a cost slashing exercise and we drive cash generation always with a view to your future strategy. We align your costs to your strategic objectives to set you up for success in the future.

Raise capital

Working with our pool of local and international investors, we have highly successful track record in raising “smart capital” to help businesses take advantage of growth opportunities.

Help leading the restructuring

When time is under pressure, we offer businesses skilled senior operators experienced in planning and implementing turnaround and restructuring. We can provide:

- An independent turnaround professional from our Turnaround Director Panel. They can step into executive or advisory roles in the business, such as Chairman, CEO, CFO, operations, marketing, human resources, non-executive directors and advisers/mentors to Boards; or

- A Chief Restructuring Officer (CRO), seconded from PwC to sit at the heart of the business. Our CROs are able to take appointments on the Board of companies, allowing them to sit at the heart of a business, alongside management.

Appointing a Turnaround Director or CRO during a time of uncertainly provides a wealth of experience and senior level resource, allowing management to focus on running the business.

Improve Management Capability

Investment in people is critical to the sustainability of your improvement initiatives and worryingly it is over looked in many transformation plans.

We can help your organisation to create capacity, drive performance and build capability through our Employee Development Program. Through the program we will work with you and your team to embed core operational principals into your organisation and ensure that a new way of working becomes business-as-usual.

Where additional resources and/or skills are needed immediately we can also step into executive or advisory roles in the business (such as COO, CEO, CFO, heads of departments), as non-executive directors and as advisers/mentors to Boards. This will enable you to quickly and flexibility increase management capacity and add critical skill sets.

Secure support of key stakeholders

Creditor negotiations and management to stablise business relationships and ensure continuity of supply through periods of cash constraints.

Our team’s extensive experience with all parties around the table, including shareholders, banks, funds, governments, employees, suppliers and customers, mean that we can effectively navigate the difference in approaches and objectives to work towards a consensual common goal.

We advise on, or lead negotiations on behalf of our clients, engaging and managing stakeholders and pre-empting issues before they arise, to smooth and guide the way through the process.

Improve the quality of management information

In our experience the significant majority of underperforming businesses have poor access to relevant and accurate management information regarding the drivers of their business. Without management are unable to make agile and proactive decision making which is essential in a turnaround situation.

We work with you to create tailored, effective and pragmatic reporting and budgeting tools designed to be used by management after our engagement has finished.

https://www.strategyand.pwc.Com/reports/zero-based-cost-management-holistic

Align organizational and operational strategies

There is significant competitive advantage for an organisation that aligns its organizational and operational structure with its strategy. It sounds simple in the text book but in our experience is something which is not executed well in the real world.

Organisations which can efficiently deploy resources to achieving their primary goals

Employees understand the strategy / communication

Optimise business processes

The business processes that have worked in the past may be trusted by your employees but may also be sub-optimal, inhibiting growth and not able to support the organisations future strategy. We can assist you with operational redesign to address root cause of under-performance, reduce complexity, realign team and improve profitability.

Sound business processes transcend daily business requirements and builds competitive advantage.

Implement effective business controls

Within six weeks we identify improvements and make profitable changes which are sustainable

Experience

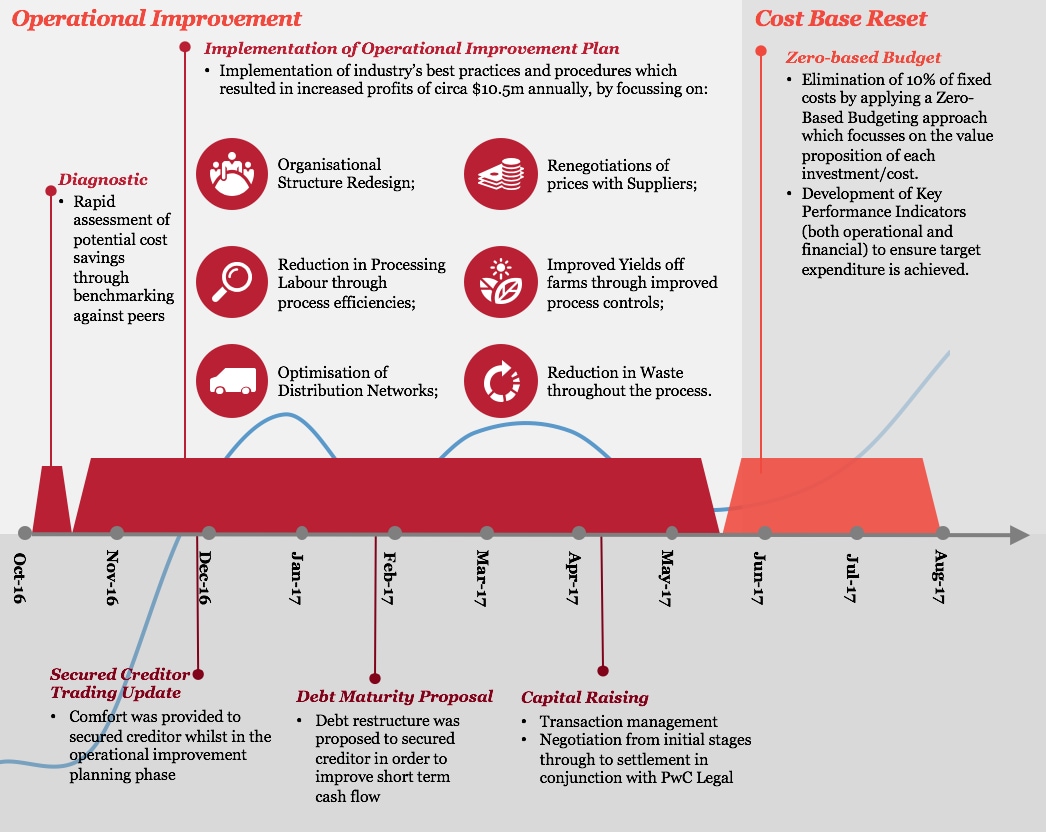

Live Case study: PwC Operational Improvement

Background

We assisted a national baby leaf producing company situated in Tasmania to develop and subsequently implement an operational improvement plan in order to improve its overall profitability.

What we did?

- We identified the key areas that needed to be addressed in order to realign the company’s cost structure and thereby ensuring profitable growth. By applying best practices and improved controls in 6 key areas we were able to improve the profitability of the company by c.$10.5m annually.

- While implementing the operational efficiencies we also assisted the Company in raising additional equity and debt capital to restructure and optimise their capital structure.

- Finally we lead a detailed Zero-Based Budgeting project with the target of releasing funds from operational cash flow to reinvest in the company’s

growth strategy.

- Working with a multi-national FMCG, PwC helped management take market share and grow from 5th largest in the Australian market to 3rd.

- This growth was only possible by completing a Zero-based Budgeting program which allowed the company to reallocate costs in low growth areas and invest those funds in high growth, highly profitable opportunities.

- PwC helped drive international growth through distribution contracts with China, Indonesia and New Zealand.

- All this was achieved while reducing operating costs and increasing profitability.

- Identified and banked $6m+ saving in the 1st financial year.

- Simultaneous improvements to revenue, profitability, working capital, staff KPI’s, risk & quality and customer satisfaction.

- Deleveraged balance sheet to levels within commercial credit risk limits.

- Refinanced debt facility.

- FY18 forecasted to be the businesses most profitable.

Operational Improvement Teams differentiators

- Hands on experience of delivery means we know how to create ambitions but achievable plans

- Team of practitioners with experience and knowledge of where to find profitable opportunities

- Implement the quick wins from week one

- Break down functional silos – bring business lines to work together on initiatives

- Commercially focused – link delivery plans to commercial objective and set up tracking mechanisms to allow the business to remain ruthlessly focused on value

- Rapid decision making – develop practical and agile governance structures to minimise bureaucracy and focus on what matters

- Put skin in the game – open to contingent fee arrangements where appropriate

- Agile – not a slave to the process, can adapt to changing needs of the business

Contact us