Australia’s M&A market looks poised for a cautious comeback amidst an uncertain macro-environment as transformative deals - with their potential to create substantial value - take centre stage

Make 2024 the year to accelerate your transformation journey

Australia’s dealmakers have greater certainty and confidence to transact right now. Our CEO survey found one-third of companies are planning to make three or more acquisitions in the next three years, and we’re already seeing early signs of an upswing in deal activity in Australia. Private capital players are looking to deploy record levels of capital ($37bn). Meanwhile, stabilising conditions mean corporate divestments are expected to resume this year, and many private family businesses will prioritise succession.

Inbound interest is buoying activity, with investors from the US, Japan and Europe accounting for some of the largest transactions in Australia in 2023. Markets for initial public offerings (IPOs) are also looking up. So far in 2024, both the US and Europe have exhibited improving IPO markets, with Europe recording its strongest start to a year since the pandemic. Similarly, hopes are high in Australia for a recovery in listings. For this to play out, the strength of global markets needs to be sustained so that confidence can continue to build in the Australian market. This confidence will require caution from Australia’s dealmakers, given the level of regulatory uncertainty, with changes looming to Australian Competition & Consumer Commission (ACCC) merger rules and continued focus from the Foreign Investment Review Board (FIRB). All being said, perhaps the second half of 2024 will herald the start of a stronger IPO market locally.

Enter: Transformational M&A

In 2024, organisations that transact to transform—that is, organisations that use transactions as a catalyst for deeper business transformation—can potentially access new capabilities and resources to fast-track growth and create significant value.

From unlocking new sources of value with technology through to accelerating decarbonisation, transactions allow businesses to transform faster than would otherwise be feasible. In fact, our Value Creation Transformation survey found more than half of corporate leaders (56%) see transactions as the best way to keep up with the speed of change in their market.

In this report, we reveal four practical plays to transact to transform in 2024:

- Play 1: Strategically using transactions for reinvention. Reimagine your business model and deliver on value creation using clear strategies for acquisition or divestment.

- Play 2: Pursuing decarbonisation and other environmental, social and governance (ESG) goals via M&A. Generate upside from ESG, and achieve ESG goals as a value creation strategy, using M&A transactions.

- Play 3: Leveraging technology to enable transformation. Capitalise on your tech and digital capabilities for faster transactions and transformations.

- Play 4: Securing talent and capabilities for transformation. Secure the talent and capabilities you need to ensure an effective and cost-efficient transformation.

We also explore common barriers to transaction-based transformation, as well as how to overcome these barriers with our ‘net-benefit checklist’ for dealmakers

Outlook: Four key ways to Transact to Transform in 2024

Whether it’s a transaction to accelerate your transformation, or a transformation to boost your deal return, transactions and transformation work hand in hand to enable businesses to create substantial amounts of value.

How much value? New PwC research shows that Australia’s top performing companies are 9.5 times more likely to embrace end-to-end transformation.

So why is this important now? Almost half (45%) of global CEOs say they do not believe their current business will be viable in a decade if it continues on its current path (up from 39% in 2023), Therefore, the impetus to reinvent is intensifying.

In 2024, there are various routes to drive reinvention and unlock new sources of competitive advantage using M&A. Here, we reveal four practical plays to transact to transform.

Play 1: Strategically using transactions for reinvention

Reimagine your business model and deliver on value creation using clear strategies for acquisition or divestment.

Play 2: Pursuing decarbonisation and other ESG goals via M&A

Generate upside from ESG, and achieve ESG goals as a value creation strategy, using M&A transactions.

Play 3: Leveraging technology to enable transformation

Capitalise on your tech and digital capabilities for faster transactions and transformations.

Play 4: Securing talent and capabilities for transformation

Secure the talent and capabilities you need to ensure an effective and cost-efficient transformation.

What is Transact to Transform all about

Checklist for dealmakers to go further, faster

To maximise value from your transaction and deliver the full potential of your deal—and to manage value blockers—we’ve devised this net-benefit checklist for dealmakers seeking to transact to transform

Step 1: Start with the ‘why’ of your deal. Apply a strategic lens and design a sophisticated program structure centred on this ‘why’. Take a holistic view of the transaction/transformation journey so you have a complete picture of the value you could unlock. Then monitor success against your original vision.

Step 2: Assess different kinds of deals to determine how best to deliver the desired result.

Step 3: Be meticulous about value. Mapping out future value upside opportunities (initiatives) is an essential part of the investment case for a transaction. Set up a robust framework to model, track, and govern achievement of these initiatives. That way, you know if you've achieved what you set out to do, and you can report your success to the market.

Step 4: Design the end-state. Map out an operating model that enables you to achieve your value upside opportunities. This ensures you realise the ‘why’ within your operating blueprint, letting you lock in value and focus on running the newly-scaled business.

Step 5: Clarify post-transaction plans early. Whether you’re resetting to support a smaller business after divestiture, or building momentum driven from new scale after acquisition; be clear about your post-transaction plans and take your people along on the journey with you.

Explore the industry insights as part of this series

Transact to Transform: How we can help you uncover and realise value

Time to make your move?

As disruption gathers speed, M&A can be the fastest and most effective way for transformative change across your organisation. Transact to Transform quantifies the value potential of a transformation opportunity pre and post deal, ensuring you have the insights and skills needed to deliver the value you planned.

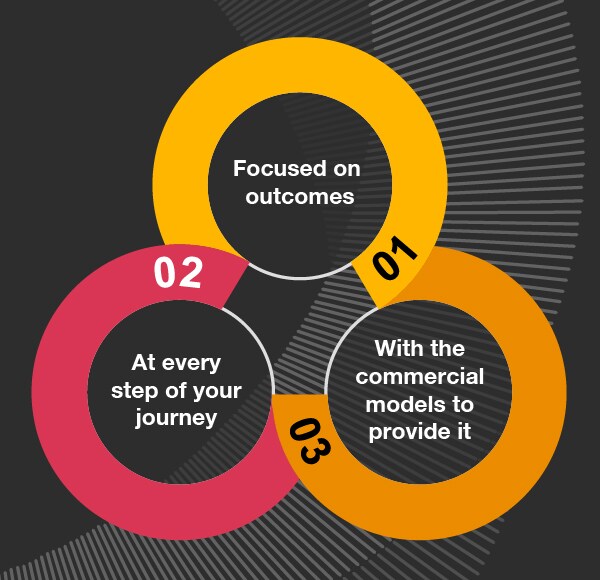

Strategy. Execution. Delivery.

We provide an end to end transact to transform service. Our deep transaction expertise focuses on optimising value creation through deal execution. While our transformation expertise, including ESG, Customer, Cloud, Workforce and Technology, ensures enduring operational solutions.

Focused on outcomes.

Whether you’re looking to transform your workforce, secure your IT, engage your customers or digitise your operations, at every step of the journey, we are focused on delivering on our promises so you can deliver on your potential.